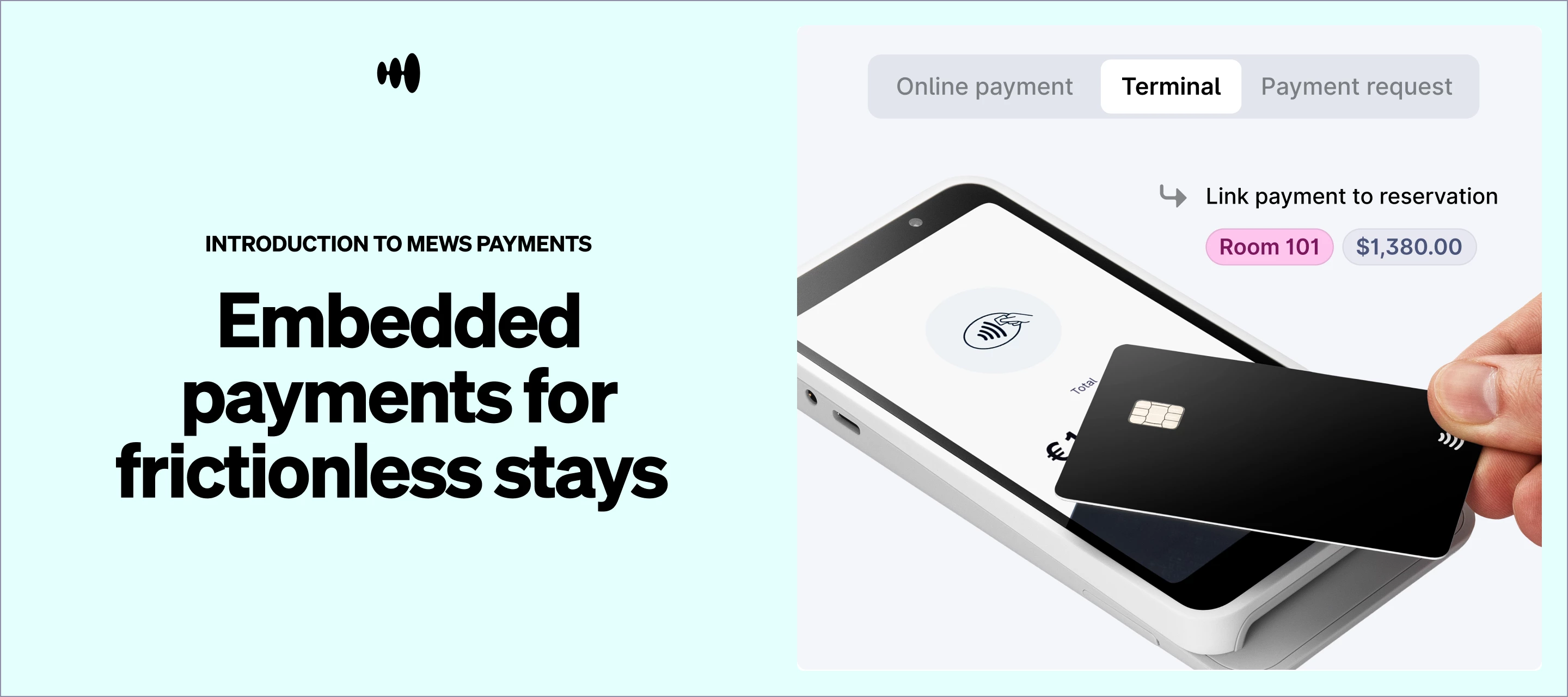

Payments are a vital part of every stay. But they shouldn’t be the main event.

Mews Payments takes the friction out of processing payments, both for guests and hotel staff, making them fast, seamless and secure.

This article explains what Mews Payments is, introduces its core capabilities and links you to further guides, best practices and step-by-step help. Let’s start with the basics.

What is Mews Payments?

Mews Payments is a payments platform that’s deeply embedded into every layer of the Mews operating system. It automates complex tasks to help drive revenue, reduce costs and accelerate cash flow – all while ensuring payments comply with global security regulations. That means staff can spend less time worrying about transactions and more time connecting with guests throughout their stay.

Core capabilities

Let’s take a look at some of the most important features of Mews Payments.

Embedded, not integrated: Because Mews Payments is embedded within the Mews ecosystem, staff don’t need to work with multiple systems, process payments manually, or spend hours on night audits to reconcile the day’s accounts. It all just... happens. Automatically and in the background.

Effortless automation: With customizable payment policies, hotels can automate every transaction from reservation to check-out, freeing staff from time-consuming manual payments so they can spend more time elsewhere.

Multicurrency: International guests can pay in their home currency, with hotels retaining part of the conversion fees that are usually kept by banks. That’s a low-effort but high-impact way to grow revenue.

Secure tokenization: Tokenization encrypts guests card details at the time of booking. That means no data is ever stored on the system and guests can pay throughout their stay without the need to keep presenting their payment details. Seamless and secure, that’s how we like it at Mews.

Terminals that sync with the system: Mews Terminals simplify and secure in-person payments, enabling customers to pay using a variety of payment methods across the hotel.

Built-in chargeback support: Mews Payments has been shown to significantly reduce chargebacks. But if they do occur, Mews sends automated notifications and shares guidance on what evidence is needed, reducing the administrative burden on hotel staff.

Unified reporting: Access detailed records for every transaction, making compliance, reconciliation, and financial reporting easier and faster.

Why it matters

According to a report created by IDC, hotels using Mews Payments see on average:

-

31% decrease in human error

-

24% more efficient front desk staff

-

6.8% increase in average daily rate

“Mews Payments have made a huge impact for us, releasing us from the hassle of manual work. The ease of use, security, better guest experience – this is exactly how hotel payments should be handled.”

— Jibbe Baas, Director of Revenue and Marketing, Hotel Lancaster

Mews Payments: Help and resources

Looking for more detail? Learn more about Mews Payments:

Apple Pay and Google Pay guest journeys, explained

How to send a payment request by email

How to create a payment policy

How to create a cashier in Mews Operations

How to set up outlets

All Mews Payments FAQs

Not using Mews Payments yet? Get in touch with us to explore how embedded payments can simplify your operations.