Hi Community!

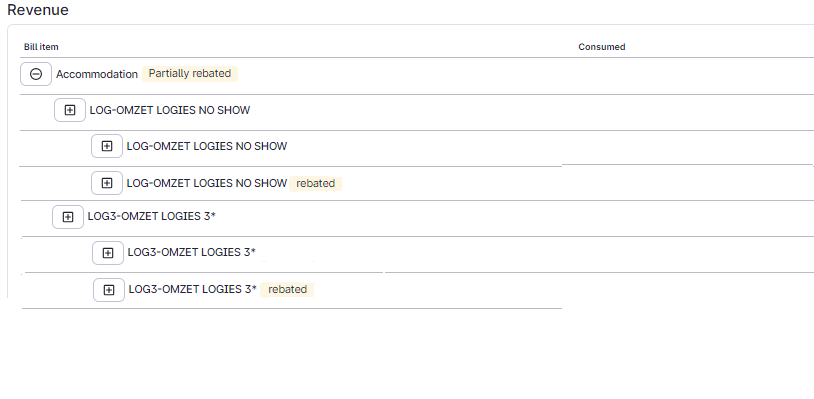

I am a Product Manager in the Finance team and I am looking for some feedback on how you use, or would like to use accounting categories for city tax rebates and cancellations.

When rebating or cancelling a city tax would you want this to be posted to the same accounting category that the city tax was originally posted to? Or is there a reason why you might want this to be posted to a different accounting category? If so, why?

Looking forward to your feedback and thanks in advance!